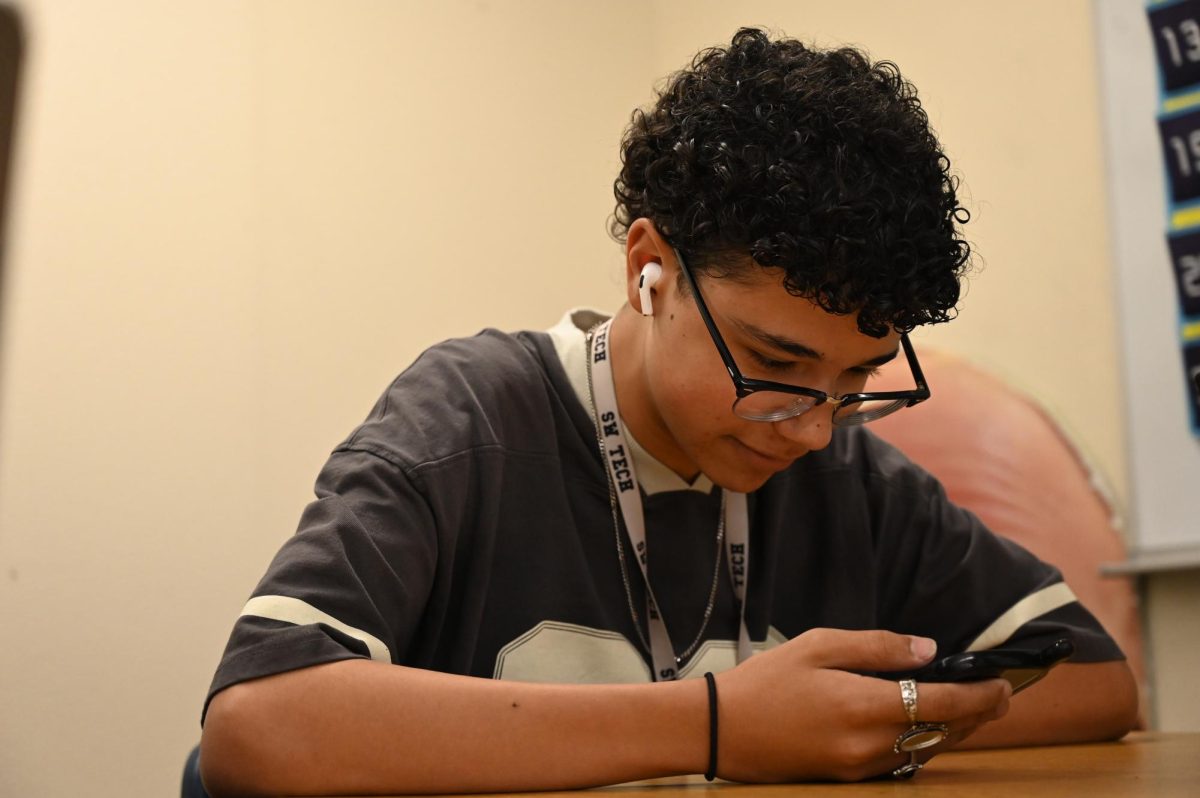

As more stress weighs heavily on teenagers, many end up choose different ways to cope, like speaking to a therapist or parent. For others, turning to more problematic solutions, like retail therapy, becomes a reality.

According to the Oxford English Dictionary, retail therapy is defined as “the practice of shopping in order to make oneself more cheerful”. A survey conducted by Penn State University showed that after a rough romantic breakup, of the 83 percent of its students interviewed, only 20 percent used a traditional form of therapy while the other 63 percent went shopping after their breakups. Over 50 percent believed that shopping improved their mood and 60 percent claimed that shopping helped them improve their self image.

“I think some people enjoy the satisfaction of getting new things or just buying things in general,” junior Mikaela Maniego said. “It probably feels best whenever they’re stressed or experiencing something that affected them a lot, which is why some depend on it so much.”

Whether or not retail therapy has a positive or negative impact is up for debate. A study done in 2011 by Selin Atalay and Margaret Meloy found that retail therapy had positive long-term effects on mood, but when feelings of negativity returned, they are what ultimately lead people to instinctively buy with lack of self control leading to a vicious cycle.

“It can be good in the sense that you found a coping mechanism that works, but it’s bad in the way that it can become an addiction and lead to a person spending a lot of their money,” Leung said.

Considering how costs fluctuate due to inflation, students believe this is making an existing problem of retail therapy even worse.

“It’s [retail therapy] definitely becoming a bigger problem,” Maniego said. “Prices are going up and when people turn to retail therapy, they’re ultimately spending more money because of that.”

Retail Therapy Infographic by Kylie Chelise Dacquel

But there’s more to the problem than just the extensive amount of money that is spent. In a survey conducted by GWI, 23 percent of Gen Z consumers in the U.S. say that they are more likely to make impulse purchases, with most of those purchases falling into the category of clothing and apparel. As Gen Z is more likely to impulsively spend money erratically to feel that happiness from wearing the newest trends, this influences how much money is being spent.

“Retail therapy is already a big problem, but it’s even worse when people decide to keep buying things without caring for the price,” sophomore Jaden Espinueva said. “If it works for them, then they’ll keep buying things and go after that happy feeling they get from making purchases.”

The effects of this type of impulsiveness are concerning for those who have friends or relatives who turn to retail therapy as their outlet.

“One of my friends uses retail therapy and I always try to help them stop spending impulsively,” junior Rediate Hunde said. “I encourage them to find other coping strategies or convince them that the money spent on whatever they’re trying to buy is not worth it.”

There are many other solutions to overcoming addictive spending habits.

“I definitely think that you should put it [money] in a safe place or entrust someone like a guardian or parent with that money,” Leung said. “If you end up going out, then take a specific amount of cash instead of a card so you don’t overspend.”

For now, the Center for Disease Control and Prevention recommends quick activities such as exercising, mediating, reflecting on what a person is grateful for, doing a self check-in, laughing, or listening to an inspirational song to combat stress. It may also help to shed light on the consequences of what retail therapy does to a person.

“I would bring it up to them and suggest they talk to someone about it,” Leung said. “I’d also personally help them find other coping strategies and try out different things to see what works best.”

![School stressors cause many students to use coping mechanisms in order to overcome the pressure; one of those outlets is retail therapy. Subsequently, students spend more money in relation to the amount of stress they have experienced, all while failing to account for their costly spending. “When they [friends] buy things they just get things that catch their eye with no specific reason for why they want to buy it,” sophomore Sapphyre Leung said. “It’s really just a way to waste money instead of being a good way to channel your stress.”

Photo Credit: Allef Vinicius](https://southwestshadow.com/wp-content/uploads/2023/10/allef-vinicius-fJTqyZMOh18-unsplash-1200x800.jpg)

![In his fifth period World History class, Thur works with his students individually, helping them as they sort through notes and assorted historical documents. “I’m always willing to try something new,” Thur said. “Some of my best ideas that I’ve received over the years are from students. This year I’m trying out stations for the first time and kids are rotating through and it’s working. Well, some things are [working], I’ve still got to work out the kinks with it. The kids change, why shouldn’t I change too?”](https://southwestshadow.com/wp-content/uploads/2025/10/IMG_8991-1200x800.jpg)

![Fast food has not stayed the same principle of “sit down, order, and get food,” but has turned into a process with multiple layers and complexity. This is largely due to the integration of automation in every aspect of dining. “I'm not that knowledgeable on it, but I've seen videos on TikTok, I'm not really concerned—it doesn’t seem that smart,” senior Dallas Evertt said. “When [some people are just ordering] 18,000 water cups, it sounds really dumb. There was no way [the AI] was gonna put down 18,000 water cups—and that just shows how it’s not going to take anybody’s job soon.”](https://southwestshadow.com/wp-content/uploads/2025/10/Dominante-Image-1200x675.png)

![Squaring up to a practice dummy, sophomore Cypher Andres prepares to throw a punch. Dummies are regularly used to help him prepare certain hits to take his opponents down. “[Boxing dummies help me practice] because it’s basically a model of the body,” Andres said. “It helps with accuracy, such as pressure points behind the ear, and a clean liver shot can end the fight.”](https://southwestshadow.com/wp-content/uploads/2025/10/IMG_5728-e1759850486200-1200x864.jpg)

![Swaying and preparing to toss the tennis ball, Dylan Grove practices serving. Grove had been training in preparation for her upcoming matches against Chaparral and Doral Red Rock. “[Both teams are] both very tough opponents, but I am ready for whatever gets thrown my way,” Grove said.](https://southwestshadow.com/wp-content/uploads/2025/10/image-1200x900.png)